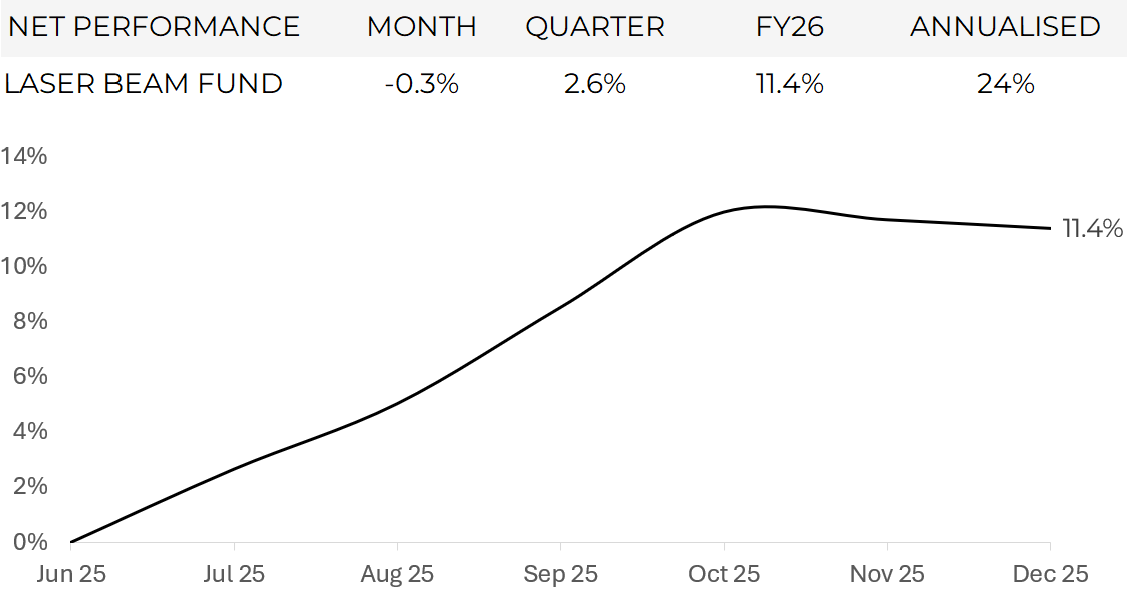

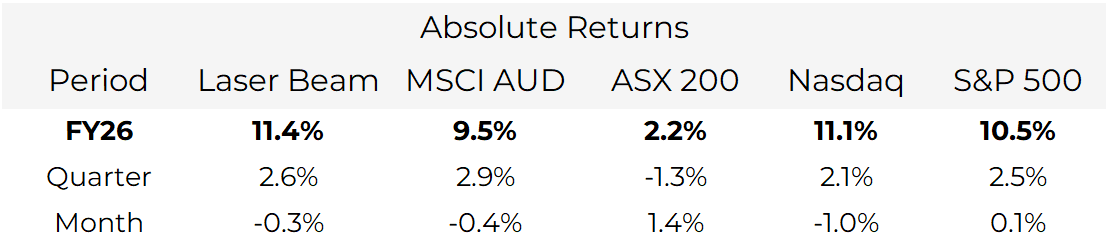

The fund returned -0.3% in December, closing our first six months at +11.4% net and ahead of global benchmarks while carrying materially less risk. More importantly, we're now positioned for what's ahead.

CAPITAL DEPLOYMENT AND POSITIONING

We took a disciplined approach over the first six months. Elevated cash and active hedging allowed us to outperform key global benchmarks while avoiding meaningful drawdown risk.

Headline returns do not reflect the risk we chose not to take. Had markets experienced a deeper sell off, relative performance would have been materially stronger.

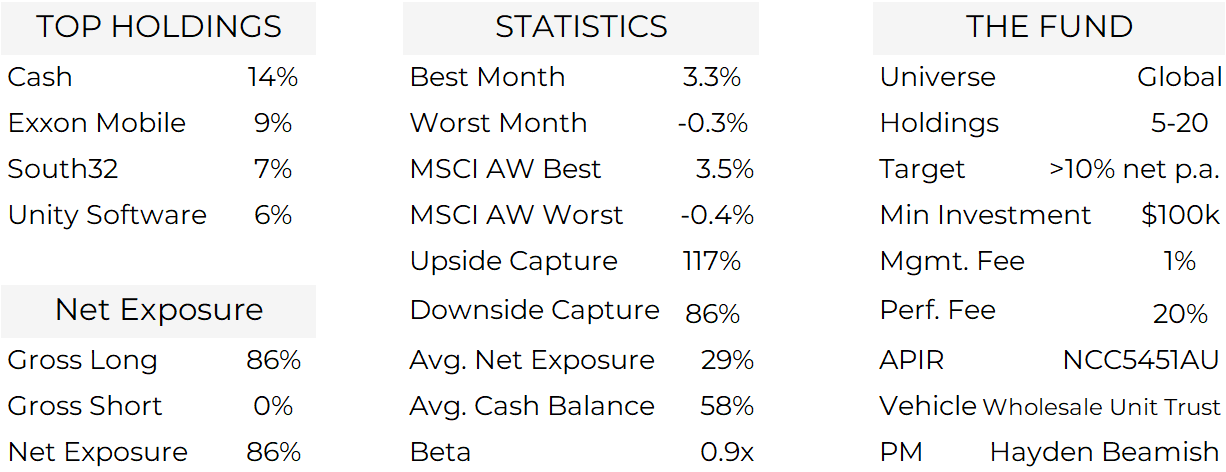

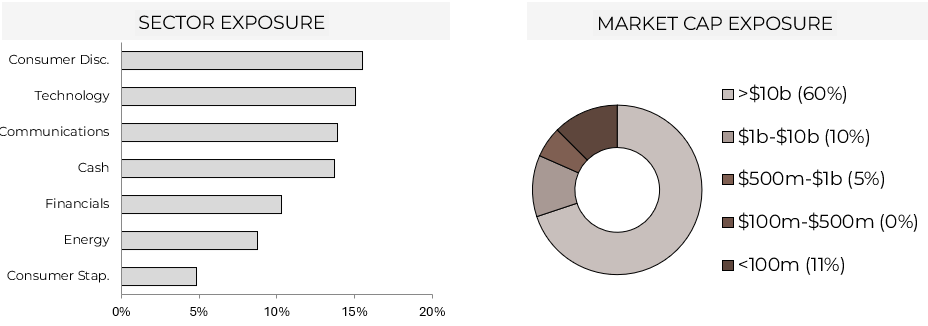

As volatility picked up from October through December, we steadily added exposure across AI software, energy, critical minerals, and select high quality global equities. Cash is down to 14% as higher conviction opportunities emerged. Position sizing and risk discipline remain central to how we operate.

AI IS ACCELERATING

AI progress is no longer theoretical. It is showing up in real workflows, cost reduction, and productivity gains. Our exposure spans both companies building core AI platforms and companies applying AI to improve products, reduce costs, and lift margins.

Unity Software is often viewed through a gaming lens, but we own it for its real time 3D engine increasingly used in industrial digital twins, simulation and training across defence, auto and manufacturing; Unity’s embedded AI creation tools (Unity AI) lower asset creation time and extend the platform beyond gaming

Lemonade is an AI first insurer: underwriting, pricing and claims are built on proprietary automation; >90% of claims start digitally, with a growing share handled end to end by AI, helping drive all time low loss ratios and narrowing losses

DigitalOcean provides simple, developer focused cloud infrastructure for startups and small teams that do not want hyperscaler complexity or cost. As AI tools allow smaller teams to build and ship products faster, DigitalOcean sits at the infrastructure layer enabling that activity

Twilio is pivoting to AI driven customer engagement. Segment Predictions and Flex Agent Copilot embed AI in routing, assist and self service, shifting the story from message volume to conversion uplift and labour cost reduction, with improving operating income despite gross margin mix pressure

Reddit represents a different but important AI exposure. It owns one of the largest and most continuously updated datasets of human conversation globally. That data is valuable for training and refining language models. At the same time, AI driven improvements in moderation and ad targeting are lifting monetisation. It combines a unique data asset with operating leverage.

Across the portfolio, the common thread is AI showing up in earnings and margins, not just capital spending plans.

COMMODITIES AND CRITICAL METALS

Electrification, AI driven power demand, and a decade of underinvestment point to structural supply constraints, particularly in copper. We also see value in energy, where sentiment remains poor.

Exxon Mobil was our largest position at month end. Strong free cash flow, capital discipline, and US refining optionality provide valuation support. We selectively hedge oil price risk when appropriate.

We also hold smaller positions across copper, gold, and lithium related exposures. These are treated as trading positions rather than long term holdings. Position sizes remain small, risk is managed tightly, and profits are taken into strength. The objective is to capture thematic tailwinds without overstaying once sentiment becomes crowded.

MACRO OBSERVATIONS INTO 2026

The setup into 2026 is supportive for active, risk aware strategies.

AI is moving beyond capex headlines and into real productivity. Cost reduction, faster development cycles, and margin expansion are starting to show up in earnings across software, services, and industrial workflows. This is becoming a broad efficiency and growth cycle, not a narrow technology trade.

Monetary conditions are also turning more constructive. More US rate cuts are likely, balance sheet reduction is ending, and the Fed has shown it will respond quickly to market stress. This reduces tail risk and creates repeated trading opportunities around volatility.

Fiscal policy remains expansionary. Large scale public and private capex programs are underway across energy, infrastructure, semiconductors, and AI related build out. Combined with a pro growth, pro technology US administration and early signs of deregulation, the environment supports earnings growth rather than just multiple expansion.

USA IPO markets are reopening, liquidity is improving, and market breadth is gradually expanding beyond mega caps. At the same time, years of underinvestment and AI driven power demand underpin a constructive outlook for commodities.

This is not a backdrop that requires being fully invested at all times. Volatility will persist, and that suits our approach. We remain focused on staying active, managing risk dynamically, and deploying capital only into the most compelling ideas.

JANUARY

January has started strongly. Month to date, the fund is up approximately 2.5% net and trading above prior highs.

You can view live performance at any time here:

https://www.laserbeamcapital.com/performance

As always, I am available to discuss positioning, outlook, or any questions you may have.

We look forward to the opportunities ahead.

Regards

Portfolio Manager

The Laser Beam Fund