Hi {{first_name}}

We are pleased to provide the Laser Beam Fund’s first monthly update.

OVERVIEW

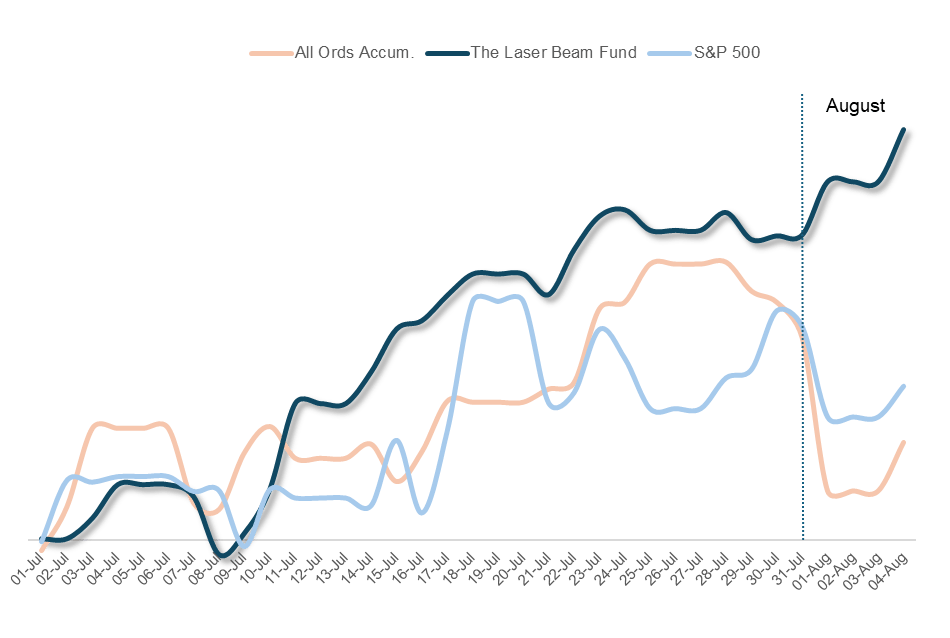

The fund finished up 2.5% net of fees, with only 30% of the capital invested and a Nasdaq hedge in place.

MONTH | YEAR | INCEPTION |

|---|---|---|

2.5% | 2.5% | 2.5% |

THE INVESTMENTS

We began cautiously, buying Advanced Micro Devices (AMD), Google (GOOG), Amazon (AMZN) and two ASX trading positions: Mineral Resources (MIN) and Clarity Pharmaceuticals (CU6).

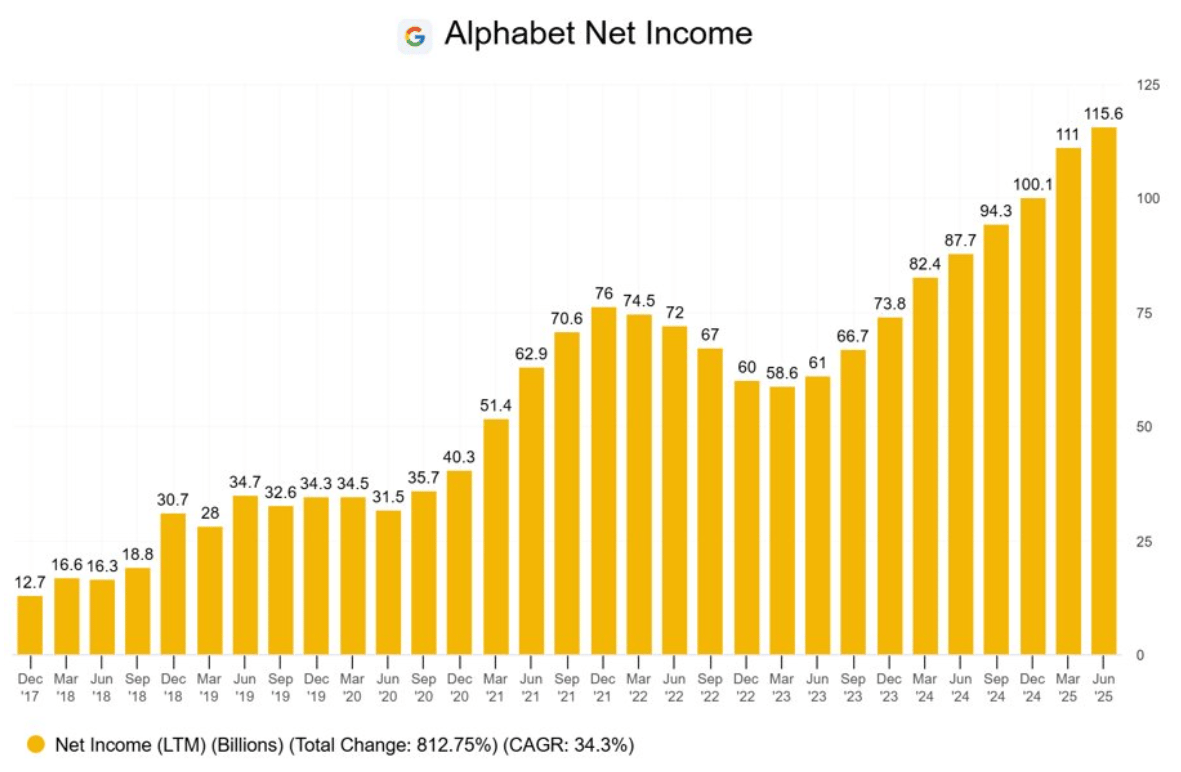

Google posted a standout quarter. It is now the most profitable company on the planet. The market worries AI might replace search. We think that risk is already in the price while the upside from AI is not.

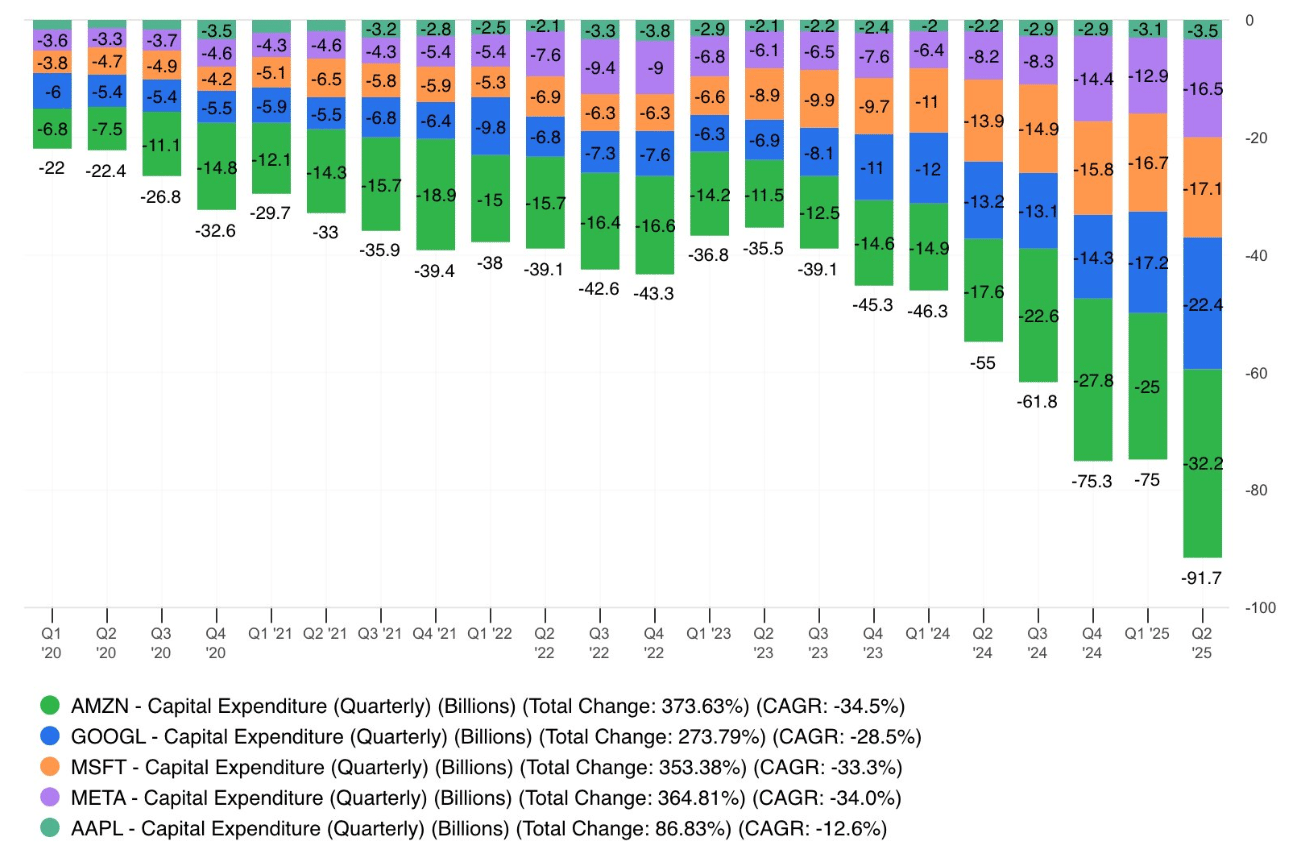

An important theme is the accelerating AI data centre spend which is now forecast to hit $1T by 2030. This wall of spending means more chips sold and higher earnings for our holding AMD. Its fast, low power silicon chips are built for AI inference (the number crunching behind real time answers). NVIDIA still dominates but it trades on a $4.2T market cap versus AMD on $260B. We believe the gap can close. AMD increased 30% in July and was the top contributor.

We also added Reddit (RDDT) just before it printed Q2 numbers: revenue +80%, gross margin 91%, EBITDA $167m. The share price is up 30% on our entry, and we look to increase this position on a pullback.

PLAYING DEFENCE

Towards the end of the month we locked in profits and increased our hedge. The hedging is insurance: it will not remove all risk, but it smooths the ride. Thanks to the hedging, on 1 August the Nasdaq dropped 2% and the fund was up.

I have low tolerance for trading losses. We will often take profits early and hedge quickly. Timing will never be perfect, but the hedging ability tilts the risk-reward firmly in our favour.

By the end of month the biggest contributors were AMD, Mineral Resources and Clarity. The main detractors were the index hedge, forex hedge and Tempus AI.

CONTRIBUTORS | DETRACTORS |

|---|---|

AMD | Index Hedge |

MIN | Forex Hedge |

CU6 | TEM |

PORTFOLIO POSITIONING

Our top holdings are Google, AMD, Alibaba and Reddit. We also maintain a modest short position in a major global financial institution and a small Nasdaq hedge to manage risk.

LOOKING AHEAD

We’re pleased with the early result, especially with only 30% of the capital deployed. That said, one month does not make a track record. We’ll continue to build exposure gradually and stay disciplined, manage risk and deploying cash only when the setup looks compelling.

LOOKING AHEAD

If you subscribed before 1 July, NAV Investor Services will email your portal credentials shortly. Open this email on your phone and install the app that suits you: iOS or Android. If you joined in July, your login will arrive early next month.

Thank you for your support. Call any time if you would like more detail.

Regards

Hayden Beamish

0407428147

92 Forrest St Cottesloe WA

www.laserbeamcapital.com